Its very commonplace for a client to visit a bankruptcy attorney. when he or she is about to be garnished by the employer. The client ultimately files a Chapter 7 and wipes out all of his dischargeable debt, generally credit cards, loans and credit card bills. How about the garnishment monies taken prior to the bankruptcy? Do you get that back? The answer may be yes, but it depends. If $600 or more was taken within the ninety day(90) period prior to the filing of the bankruptcy, it may be deemed a preference to that one creditor. If the creditor refuses to return those monies, then the attorney may commence an adversarial proceeding to recover those funds as a preferential transfer for the benefit of that creditor to the detriment of all other creditors. In simple language, the creditor may need to give back all the monies during that 90 day period. Not all attorneys are tuned into this. This is a nuance area of the law so you may need someone to fight for your rights and you need to get firm legal advice. If you need a Bronx/Westchester bankruptcy attorney, call for a free telephone consultation.

Category: Uncategorized

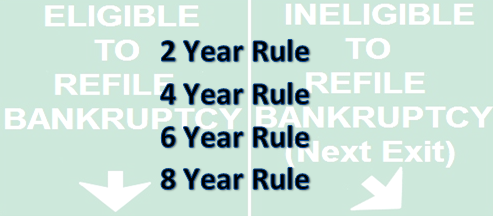

2, 4, 6, 8 | Rules for Refiling a Bankruptcy

There are many reasons why you might need to filing a Chapter 7 or Chapter 13 bankruptcy a second time; but, you need to know the rules of the road with the help of a knowledgeable and solid bankruptcy attorney.

2 Year Rule

This applies when you have successfully completed a Chapter 13 (you received your discharge) and need to file again. This may occur because you may owe post-filing taxes or mortgage arrears. You may file again and receive a discharge if two year elapsed from the date of the first filing. Thus, if you filed a Chapter 13 on March 1, 2011 and receive a discharge on March 1, 2016, you may immediately file another Chapter 13 and get a discharge. The two year period is measured from date of the first filing to the date of the second filing. Thus, almost everyone will be eligible in this scenario to file and get a discharge because almost all successful Chapter 13 bankruptcies take longer than 2 years to complete.

4 Year Rule

This applies when you have successfully completed a Chapter 7 (received a discharge) and wish to file a Chapter 13. This may occur because you owe taxes that were non-dischargeable in the Chapter 13 or you may wish to wipe out a totally underwater 2nd mortgage that could not be done in a Chapter 7. This does not mean that could not file a Chapter until 4 years after a Chapter 7. You could but you will not receive a formal discharge notice. In many cases, it will not be necessary to have the discharge. Once again, the 4 year period is measured from date of the first filing to the date of the second filing.

6 Year Rule

This applies when you have successfully completed a Chapter 13 and now wish to file a Chapter 7. In order to receive a discharge in the subsequent filing, there is a look back to the previous Chapter 13. If 6 years have gone by from date of filing on the Chapter 13 to the date of filing on the Chapter 7, you will be eligible to receive a discharge in the Chapter 7. However, you still may get a discharge in less than 6 years if you paid back 100% of your debts in the prior Chapter 13 or you if paid back 70% of your debts and the plan was both proposed in good faith and was your best efforts. This is a little more complicated that the other rules and will need an experienced Bronx/Westchester attorney to assist you.

8 Year Rule

This applies when you have successfully completed a Chapter 7 and now wish to file another Chapter 7. Once again, the measuring period is from the date of filing of the first bankruptcy to the date of filing for the second Chapter 7.

These rules can be highly nuanced and the choice of refiling can be very tricky. You should only consult a competent and experienced Bronx/Westchester consumer bankruptcy attorney before making such a decision. There are so many traps for the unwary.

Good News for a Short Sale Option- The Extension of the Mortgage Forgiveness Debt Relief Act

If you have completed a short sale during 2015 or are contemplating a short sale in 2016, there is good news.

The Mortgage Forgiveness Debt Relief Act recently passed by Congress in December and signed into law by President Obama forgives any cancellation of debt in both 2015 and now in 2016 as a result of a short sale. Thus, if you entered into or will enter into any short sale arrangement wherein the bank forgives the difference between the amount owed and the purchase price, there will be no tax consequences provided that:

- the house has been used as your principal residence for at least two of the previous five year

- The mortgage was used for the purchase of the house or used to make significant improvements to the property; and

- The debt forgiven was for a sum no greater than $2 million dollars.

Thus, for homeowners who have used their property as their primary residence and wish to unload this property (which may be a financial burden to them as well as a nuisance-city violations and potential squatters as examples if the property has already been vacated), this can be quite a blessing. As a result of a short sale, you would not owe any money to the bank, assuming the bank agrees, and you would not owe money to IRS if you satisfy all of the above conditions.

The best advice is to seek legal counsel from an experienced Bronx and Westchester bankruptcy and real estate attorney who will explain the pros and cons of a short sale transaction versus filing a Chapter 7 or Chapter 13 bankruptcy

Bankruptcy Documents Get a Real Overhaul

Effective December 1, 2015, the bankruptcy forms get a serious overhaul. In an effort to simplify the forms and provide an easier forum for pro se debtors (debtors filing without the benefit of an attorney) to file a bankruptcy, the forms underwent major revisions. However, as they say, the best of plans are often led astray. What used to be a three page petition portion of the bankruptcy filing has turned into an 8 page portion. There is so much information within the new forms, arguably to assist and clarify issues. But the clutter just makes it harder to manage and more difficult to understand.

When listing creditors, the forms have combined tax debts (priority debts and general unsecured debts (mostly standard credit cards, store cards, and personal loans) into one form. You are required to list those general unsecured debts in Part 2 and then link any additional notice creditors or collection agencies listings to its respective creditors so that the latter appear only in Part 3. It seems a challenge even for the initiated (attorneys and staff) and troublesome to overwhelming for the uninitiated (pro se debtors).

This change seems to have more twists and turns than bankruptcy forms made easy or the effort to write forms that mimic the series- “bankruptcy for dummies”.

If you need an experience Bronx and Westchester bankruptcy attorney to help you sort out this mess, call our office for a free telephone consultation.

THE SECRET INCREASES IN NEW YORK STATE EXEMPTION

It is commonly asked by prospective bankruptcy clients if they will be able to keep their primary residence while filing a Chapter 7 or in the alternative whether they need to do a Chapter 13 to accomplish the same. So much depends upon the value of the property, the mortgage payoff(s), and the exemption permissible under the law. If you live in New York City and many of the surrounding counties, you are allowed what is known as a homestead exemption.

The exemption was increased from $50,000 to $150,000, effective January 21, 2011. The law also provided for automatic adjustments based upon the Consumer Price Index every three years, starting with April 1, 2012. There was hardly a soul in the bankruptcy community who knew that the exemption was increased in 2012 to $157,600 and more recently increased to $165,500 as of April 1, 2015.Some trustees and even bankruptcy judges are still not yet familiar with these changes. It can make a world of difference in qualifying for a Chapter 7 or what you pay in a Chapter 13.

It pays to find an experienced attorney in the Bronx and Westchester community who knows the law. I guess the secret is out and we can’t make up for lost time .It is a matter of dollar and cents and SENSE.

Obama’s Loan Modification Program Gets a Bad Report Card

A recently released study by Cristy L. Romera, as reported in the New York Times, charged by the government to monitor the progress of government loan modifications, has announced that 72 percent of applications by borrowers have been rejected. Citibank, Chase, Bank of America and Wells Fargo, are amongst the worst offenders. Their percentage rejection rates are: 87, 84, 80, and 60. Thus from the period of 2009 through approximately 2014 there were 4 million applications for a government loan modification of which only 881,000 received some sort of mortgage relief. The bank are notorious for slowing down the process by misplacing documents, losing documents, requesting the same documents more than once, and other requests that just add time to a speedy resolution for a loan modification request. Although the banks may reject the numbers and analysis with this report, for anyone involved in the loan modification process understand the obstacles bank impose for a timely review. Some people believe that bank have a financial interest in delaying the process and intentionally slow down the process for the purpose of jacking up the ultimate mortgage obligation by the borrower. Others believe that the banks are just plainly negligent and disrespectful of the process. In either scenario, so many borrowers lose their home, lose hope, and lose faith in the system. If you need a Bronx/Westchester attorney to help you with your mortgage issues, call David J. Babel, Esq., P.C.

Changes Proposed to Shorten Foreclosure Time Process in New York

Individuals who are seriously delinquent with their mortgage payments or for those who have actually received that thick packet of foreclosure papers have one very important concern. They want to know how long they have to live in their house before they am thrown out. In New York it takes an average of over 900 days or 2.5 years to complete the foreclosure process. This is double the national average according to a recent New York Law Journal article. The reason for the delay is the settlement conferences that are mandated in New York between the borrower and bank representative mediated by a referee. The purpose is to provide a mechanism and opportunity for both parties to negotiate in good faith towards a resolution of the delinquency. In most cases there is an attempt to facilitate a potential loan modification provided by the bank to the borrower. However, these meetings get bogged down by both sides. The banks often do not have representative at these who have the authority to make a decision. Banks are notorious for misplacing documents. Borrowers are often remiss in providing all the documents in a timely manner. There are numerous adjournments and lots of finger pointing. Who acted in good faith? Who acted in bad faith? In the meantime, the foreclosure cases stay on the court docket for years. The New York State Department of Financial Services is proposes changes to accelerate the process, especially for those homes that have been abandoned by the homeowner. Additionally, the proposed law would enable the referee hearing these cases to impose sanctions upon the wrongdoer, be it the borrower or the lender. Time will tell if the backlog of foreclosure cases will be substantially reduced with any new legal provisions affecting the foreclosure process. For now you will not be thrown out so quickly. Stay tuned. If you need an experienced Bronx/Westchester attorney, call our office.

Extended Foreclosure May Result in Lender’s Loss and Borrower’s Gain

For years many lenders have started foreclosure actions but have failed to conclude the legal matter. Some foreclosure defense attorneys are using the statute of limitations as a defense for which six years may have elapsed since the mortgage lender has declared the loan immediately due and payable, also known as acceleration.

The New York Law Journal reports in a recent article that there are 92,000 pending foreclosures in New York and an unknown number of cases may fall into this potential situation where the banks’ foreclosure claims would be time-barred as a result of their tardiness. However, even if the bank can’t foreclose, they still have a lien on the property. The homeowner, if successful with this defense, would have the right to live there without fear of being thrown out, but would have to square up with the bank if they ever refinanced or decided to sell the property. That would be quite a conundrum.

In one Suffolk County case, the judge dismissed the foreclosure case because the bank unduly and unreasonably delayed in pursuing the matter. It is being appealed by the lender. The simplest solution would be for the banks to offer loan modifications at the outset or speedily go through the foreclosure process to obtain title or sell the property at an auction sale. Maybe the thought of losing the ability to foreclosure will spur the banks to make more timely decisions along the way.

If you are contemplating bankruptcy as a result of credit card debts, medical bills, taxes, or mortgage arrears, consult an experienced Bronx/Westchester attorney.

Proposed New Rules for Payday Lenders

The federal agency responsible for monitoring the banking industry, The Consumer Financial Protection Bureau, is proposing new rules to protect the American public from some of the unscrupulous lending practices of the payday lenders. The Agency is trying to find the right balance between predatory lending and the free flow of credit for people in need of short-term loans. Different options according to the New York Times may require lenders to actually evaluate a borrower’s income and expenses for feasibility of repayment.

They may also require lenders to set limits on the amount that may be lent to a given individual. Other rules may put a cap on the actual interest rate charged, possibly 28%. In New York, the cap is 16%. All of these proposed measures are designed to regulate an industry where so many borrowers are caught in a vicious trap of rolling one loan into another with no way out, but bankruptcy.

Payday loans are now considered a major reason why people look to bankruptcy laws to provide relief from these exorbitant loans and the aggressive conduct of these creditors and their collection agents. If you are caught in one of these payday loan dilemmas and need a Bronx/Westchester bankruptcy attorney, call our office for a free telephone consultation.

Some relief in sight for Consumers regarding the Credit Reporting agencies

Experian, Equifax, and Transunion have come to terms with New York’s Attorney General’s office concerning the reporting of debt to its bureaus. The agencies will be required to hire specialists to handle consumer disagreements when a complaint has not been successfully resolved. It will no longer be enough to discount a consumer allegation of wrongful entries or simply refer it back to the lenders. The bureaus will need to evaluate the complaint by consumers and accept or reject the findings of the creditor based upon its own investigation.

The reporting agencies have accepted the need to provide greater accuracy because of the importance of credit scores in our society, be it for auto loans, mortgage loans, lines of credit, credit card issuance, and rental housing, to name a few.

As well, the agreement will have national implications because many of the provisions will not only apply to New York State but will apply to the rest of the country. This will eliminate a dual system of resolving issues. A unified approach will allow their policies to be implemented based upon a singular rule.

All this is good news for consumers who struggle to have errors corrected in a timely manner. If you have debt that has become unmanageable, consult a Bronx/Westchester bankruptcy attorney and get a free telephone consultation.